STEP-BY-STEP INSTRUCTIONSStep 1: Complete the Form Step 2: Accompanying Document(s)You may also need to include a memorandum of costs if you incurred additional costs.Step 3: File Your DocumentsFile the following items with the court: Check your court for filing options. Some courts mandate eFiling.If the court you are trying to file with is a Mandatory eFiling Court, you will need to place a County Recording Order.If the court you are trying to file in does not provide eFiling, you will need to prepare the following.• Abstract of Judgment (original + 2 copies)

• Memorandum of Costs After Judgment (original + 2 copies), if applicable

• The filing fee (currently $40, current fees at

• Self-addressed stamped envelope with sufficient postage to return the documents to you.

File your documents at the filing window, or in dropbox. The clerk will return the original

abstract of judgment to you with the court’s seal on it. This may take several weeks.

Step 4: Record the Abstract of JudgmentYou will need to record your abstract of judgment in each county where the judgment debtor owns

the property. You need only one abstract of judgment per county, even if the debtor owns multiple

properties. You may record an abstract of judgment even if the judgment debtor does not currently

own property; this will allow a lien to be placed against any property the debtor may acquire in the

future. When using the CountrywideProcess.com portal to eRecord, please ensure your documents are scanned in black and white, in 300 DPI, and have a 1/2 margin around the document in order to avoid rejections. Once the Abstract of Judgment is recorded, the County Recorder will return the recorded Abstract of Judgment electronically.

Step 5: What Happens Next?The county recorder will provide notice to the debtor that you have recorded the abstract of judgment.

You will not be paid automatically, but if the debtor refinances or sells the property, you may get paid

your money with interest. The lien created by the recorded Abstract of Judgment continues for 10 years from the date of entry of the money judgment and can be renewed for additional 10-year periods, until the judgment is satisfied. When you need to renew your Abstract of Judgment, you will need to prepare new Abstract of Judgment form with the updated amount owed to you (including any accumulated interest), and you will need to record it in the appropriate county or counties.Click here to see our blog on how to eRecord.

STEP-BY-STEP INSTRUCTIONS

Step 1: Complete the Form

To place a judgment lien against real property, you must complete an Abstract of Judgment.

Step 2: Accompanying Document(s)

You may also need to include a memorandum of costs if you incurred additional costs.

Step 3: File Your Documents

File the following items with the court: Check your court for filing options. Some courts mandate eFiling.

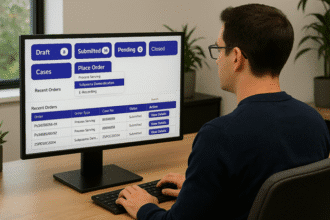

If the court you are trying to file with is a Mandatory eFiling Court, you will need to place a County Recording Order.

If the court you are trying to file in does not provide eFiling, you will need to prepare the following.

• Abstract of Judgment (original + 2 copies)

• Memorandum of Costs After Judgment (original + 2 copies), if applicable

• The filing fee (currently $40, current fees at

• Self-addressed stamped envelope with sufficient postage to return the documents to you.

File your documents at the filing window, or in dropbox. The clerk will return the original

abstract of judgment to you with the court’s seal on it. This may take several weeks.

• Memorandum of Costs After Judgment (original + 2 copies), if applicable

• The filing fee (currently $40, current fees at

• Self-addressed stamped envelope with sufficient postage to return the documents to you.

File your documents at the filing window, or in dropbox. The clerk will return the original

abstract of judgment to you with the court’s seal on it. This may take several weeks.

Step 4: Record the Abstract of Judgment

You will need to record your abstract of judgment in each county where the judgment debtor owns

the property. You need only one abstract of judgment per county, even if the debtor owns multiple

properties. You may record an abstract of judgment even if the judgment debtor does not currently

own property; this will allow a lien to be placed against any property the debtor may acquire in the

future. When using the CountrywideProcess.com portal to eRecord, please ensure your documents are scanned in black and white, in 300 DPI, and have a 1/2 margin around the document in order to avoid rejections. Once the Abstract of Judgment is recorded, the County Recorder will return the recorded Abstract of Judgment electronically.

the property. You need only one abstract of judgment per county, even if the debtor owns multiple

properties. You may record an abstract of judgment even if the judgment debtor does not currently

own property; this will allow a lien to be placed against any property the debtor may acquire in the

future. When using the CountrywideProcess.com portal to eRecord, please ensure your documents are scanned in black and white, in 300 DPI, and have a 1/2 margin around the document in order to avoid rejections. Once the Abstract of Judgment is recorded, the County Recorder will return the recorded Abstract of Judgment electronically.

Step 5: What Happens Next?

The county recorder will provide notice to the debtor that you have recorded the abstract of judgment.

You will not be paid automatically, but if the debtor refinances or sells the property, you may get paid

your money with interest.

You will not be paid automatically, but if the debtor refinances or sells the property, you may get paid

your money with interest.

The lien created by the recorded Abstract of Judgment continues for 10 years from the date of entry of the money judgment and can be renewed for additional 10-year periods, until the judgment is satisfied. When you need to renew your Abstract of Judgment, you will need to prepare new Abstract of Judgment form with the updated amount owed to you (including any accumulated interest), and you will need to record it in the appropriate county or counties.

Click here to see our blog on how to eRecord.

Ask us about our High Volume Filer Discount as low as $25.00 plus costs and advances.

Have questions?

Contact us now at:

888.962.9696

Emergency Line 323.425.8097

or email us at

info@countrywideprocess.com