Through the use of tax preparation software that has been given approval by the appropriate tax authority, tax returns can be electronically filed. E-filing has grown in popularity over the past several years due to how convenient and effective it is. Using electronic filing, according to the IRS, expedites tax refunds and reduces delays.

Whether you are looking for assisted e-filing in Los Angeles, Orange, Kern County, Riverside, San Bernardino, Sacramento, professional services law firms can take care of the necessary assisted e-filling for you. The taxpayers are exempt from having to go before a tax inspectorate. A taxpayer office can send practically any type of information at any time of day. Tax returns and accounting paperwork can be sent electronically without having to be duplicated on paper.

Error rates are significantly decreased using e-filing software. The software enables automated tax and accounting reporting verification, more accurate data processing, and standard reporting. When filing electronically, the taxpayer can request an official statement (output printing on tax) from the tax authorities attesting to their compliance. The tax authority also transmits such data via an authorised operator in a secure format.

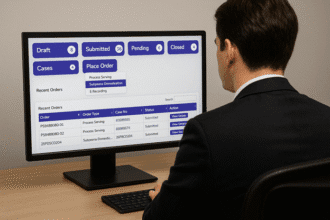

Fees vary by state and by court location, and in California where we mainly operate, it is – Per Envelope: $3.50 – $5.00, depending on the county. Mail Services tend to cost about $5.00/each. The courts now face a new challenge as a result of the adoption of electronic filing: automating the collection of court filing fees (both those required by state court rules and local court regulations).

When data from a return is transmitted directly to the tax authority’s computers through electronic filing, input errors are considerably reduced, saving both time and money. According to the IRS, using tax preparation software to file electronically reduces math errors and missing entries made by taxpayers. If there are no problems with their tax return, most taxpayers who e-file and give direct deposit information can anticipate receiving any due refund within 21 days.

The usage of credit cards during E-filing California tax return, E-filing in Los Angeles California, e-file in orange county or e-file in San Diego is the most accessible solution for this. As a result, Tyler Technologies, the provider of the court’s EFM software, collects court filing costs through their Tyler Online Payment Gateway (TOGA). They then deliver the funds to the court. Yet, credit card companies charge the courts a transaction fee when accepting credit cards. The E-File California court charges filers their own Court Convenience Fee because it is unwilling to risk losing that money. The fee is added to the credit card transaction, and the amount varies from state to state.

You can read a beginner’s guide to document e-recording.