Debt collection is undoubtedly a complex process, particularly in a state as large as California. Obtaining money from creditors certainly involves numerous legal procedures. One of the crucial steps in this entire process is the application of Abstracts of Judgment. If correctly applied, it can significantly aid in the recovery of the amount. In this blog, we’ll talk about what abstracts of judgment are, the use of electronic filing in California to help file these legal documents, and why that process is essential for successful debt collection efforts.

What Are Abstracts Of Judgment, And Why Do They Matter?

An abstract of judgment is a legal document representing a court judgment summary. It lists the parties’ names, the amount owed, and the judgment date. Why is this document important in the debt collection process? This document serves as a lien on the property of the debtor. This would mean that whenever you file an abstract of judgment, it automatically attaches to any real property the debtor owns in the county where it is recorded.

An abstract judgment may prevent the debtor from selling or refinancing property during the debtor’s lifetime or at death until the debt is paid. Such legal leverage may make debtors pay up what they owe sooner. Abstracts of Judgement are useful tools creditors use to enforce the law for their protection.

Its filing process may be daunting, but California’s electronic filing system eliminates the redundancy. Let’s delve deeper into this system to understand its significant benefits for creditors.

California E-FILING ABSTRACTS OF JUDGMENT

Technological advancements have expedited lawful procedures. In California, electronic filing offers the convenience of filing legal documents online for creditors, saving time. Electronic filing also saves significant time by eliminating the need for in-person courthouse visits. Electronic filing is especially useful in a scenario involving filling out ABSTRACTS OF JUDGEMENT.

Here is how to do it:

Ensure the proper execution of the Abstract of Judgement: The judgment’s abstract will include the judgment debtor’s name and address, along with the amount of the judgment awarded. Please double-check this information, as any mistakes could delay the entire proceeding.

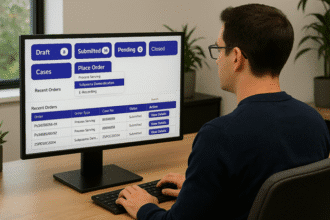

Online E-FILING System Access, California: Every county in California has its electronic filing system. Access the online system for your jurisdiction. If you’re filing this in a different county, know the specific requirements.

Use the electronic filing system to upload the completed abstract of judgment for electronic filing. The system will walk you through the process, which is pretty straightforward. You must also pay any filing fees at this point.

Track status online: After filing the abstract of judgment, you can use the electronic filing system to track its status. This system will provide updates, enabling you to follow up on your follow-ups and understand when and why something went wrong.

Online e-filing saves precious time and efficiently proceeds with other debt collection aspects. There’s no need to elaborate on the significant benefits of this procedure, particularly when handling multiple abstracts of judgment for various counties in California.

How Abstraction of Judgment Helps in Debt Recovery

Once correctly entered, an abstract of judgment remains valid for ten years. Meanwhile, creditors hold a lien on all the debtor’s property and can renew the abstract if the debt remains unpaid for ten years. Debtors have every reason to believe that creditors will have ample time to collect what they owe.

Let’s consider a few practical ways in which an abstract judgment can help collect debt:

Recording an abstract of judgment permits garnishment of the debtor’s wages. In other words, some of his salary will automatically go toward repaying the debt. The abstract also acts as a lien against all the debtor’s property, potentially encouraging the settlement of this debt.

Public Record and Credit Impact: The abstract of judgment becomes a matter of public record. Debtors know that the impact on their credit report will reduce their likelihood of obtaining loans or mortgages. Realizing the impact on their credit score, many debtors are more inclined to settle their debts. The credit impact can be a big incentive to settle.

Preventing the Sale of Properties: An abstract of judgment prohibits a debtor from selling or transferring his real estate without first paying for the judgment. This gives the creditors excellent bargaining power. The debtor, in effect, can make no significant financial move until the judgment is satisfied.

These advantages include supporting the interests of the creditors through protection. The strategy for filing abstracts of judgment is straightforward and effective, particularly in assessing the success of debt collection. Furthermore, the online electronic filing system in California has significantly simplified this process.

The Online Electronic Filing And The Simplification Of The Process Of Abstracts Of Judgment

The California online electronic filing system has made it possible to upgrade what was considered a long-stretched process in the past. Instead of going physically to a courthouse, creditors now have the option to fill out and submit abstracts of judgment from the comfort of their homes or offices. As such, it has become seamless for creditors to keep abreast of their claims in different counties without physically appearing in the various courts.

Advantages Of California Online E-FILING:

Time Savings: Online electronic filing eliminates paper filing. This results in significant time savings as it allows for the timely filing of numerous abstracts of judgment. This enables creditors to find time for other cases or business activities.

Cost Savings: There is reduced travel and documentation in the papers. And although there are filing fees with electronic filing, the overall cost is usually cheaper than any other method.

Greater Accessibility: With the development of online monitoring and tracking of filings, creditors can easily track filings. The process is transparent throughout, thus eliminating unwanted delay and surprise lines.

Suppose you are a creditor or attorney using abstracts of judgment. In that case, having complete knowledge about online electronic filing will go a long way toward making it possible for you to collect those debts. It is a modern solution that caters to today’s fast-paced and busy legal environment.

Why Creditors Need To Use Abstracts Of Judgment AND E-FILING

Everything counts in debt collection. Abstracts of judgment serve as legal methods for collecting unpaid debts, enabling creditors to place liens on any property the debtor owns, thereby impacting the debtor’s credit rating. It does not make debts easier to ignore and gives the creditor a higher chance of recovery.

California’s electronic filing system has made filing these abstracts much easier and more efficient. One can easily file abstracts of judgment online through electronic filing, letting one file and follow up on the status without visiting a courthouse. It saves time and expense, keeping a lid on the cost and effort involved in such collection activities for a creditor.

Suppose you are a creditor seeking to optimise your debt collection process in California. In that case, you can succeed by utilizing abstracts of judgment and online electronic filing tools. These tools guarantee the complete protection of your claims, enabling you to achieve the desired outcomes for your debt recovery journey.